So, how much should we withhold on the bonus? How should we set up that bonus pay in Dynamics GP?

The first question you need to answer is whether or not the payments are considered Supplemental Wages for Federal tax withholding purposes. Whether wages are classified as regular wages or Supplemental Wages may have significance in determining the amount of income tax required to be withheld. Most bonuses that I’ve seen are in fact Supplemental Wages.

The answer to the withholding question is as close as Internal Revenue Bulletin 2008-24, which outlines nine different scenarios and explains the withholding requirements for each scenario. The nine different scenarios include:

- Commissions paid at fixed intervals with no regular wages paid to the employee;

- Commissions paid at fixed intervals in addition to regular wages paid at different intervals;

- Draws paid in connection with commissions;

- Commissions paid to the employee only when the accumulated commission credit of the employee reaches a specific numerical threshold;

- A signing bonus paid prior to the commencement of employment;

- Severance pay paid after the termination of employment;

- Lump sum payments of accumulated annual leave;

- Annual payments of vacation and sick leave; and

- Sick pay paid at a different rate than regular pay.

Simply defined in IRS Publication 15, “Supplemental Wages are wage payments to an employee that aren't regular wages. They include, but aren't limited to, bonuses, commissions, overtime pay, payments for accumulated sick leave, severance pay, awards, prizes, back pay, retroactive pay increases, and payments for nondeductible moving expenses. Other payments subject to the supplemental wage rules include taxable fringe benefits and expense allowances paid under a non-accountable plan.”

How you withhold on supplemental wages depends on whether the supplemental payment is identified as a separate payment from regular wages. See Regulations section 31.3402(g)-1 for additional guidance.

If you are running a separate check run or separately identify the ‘non-regular’ wages in your records, they are treated as Supplemental Wages. The most obvious would be a bonus check. The IRS provides that you should withhold at a flat rate of 25% rather than aggregating the bonus with the regular wages.

If the bonus exceeds $1,000,000, you are required to withhold at a rate of 39.7% on the amount in excess of $1,000,000. These amounts and percentages can change every year, you’ll want to check each year and make the appropriate adjustments to your relevant pay codes. The rules are quite complex regarding withholding on Supplemental Wages. The best explanation I’ve found are the scenarios described in Rev. Rul. 2008-29

If you are running a separate check and do not treat it as supplemental wages, the withheld amount will most likely be incorrect. For example, if you run the bonus with an annual frequency, it’s likely no tax would be withheld on a modest bonus. If you include it with regular pay in a semiweekly pay period, it’s likely that too much will be withheld.

FICA/s and FICA/m withholdings are a fixed amount, so those would be calculated the same no matter what kind of wages you're paying.

If you include the bonus with the regular pay, the withholding percentage could be much higher than 25% because of how pay is aggregated. The bonus pay plus the regular pay are added together and withholding is calculated on the annualized sum of the two.

This article speaks only to Federal tax withholding, you'll need to check your state withholding rules on supplemental wages to see how the state requires you to withhold.

Setting it up in Dynamics GP

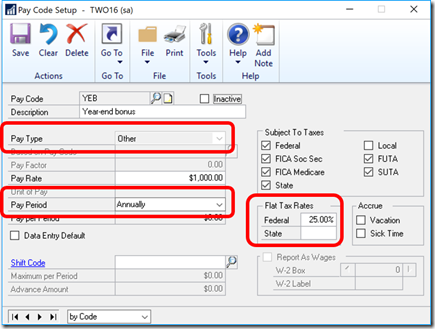

For Dynamics GP, here’s how you would set up a Bonus pay type using flat rate withholding.

I have three elements highlighted on the screenshot above.

- Pay Type

- Pay Period

- Flat Tax Rate

I use the Pay Type of ‘Other’ because a bonus doesn’t fit into any of the other categories

I use the Pay Period of annually because this is a bonus given just once per year. If they get a bonus quarterly, then select a Pay Period of Quarterly.

The Flat Tax Rates section is where you would enter the pre-defined percentage for withholding against the bonus amount. This flat tax does not apply to any other pay codes

What difference does it make?.

This section will show you the amounts withheld for Federal Income Tax under several scenarios.

The following calculations are based on these facts: The bonus is $1,000 and it is a year-end bonus. . I used Fabrikam’s Pillar Ackerman for my test subject. She has $122.95 of ‘before tax’ deductions so I applied the tax rates to $877.05 ($1,000 – $122.95). This explains why the 25% flat tax on the bonus was less than $250.

1. Bonus Pay Period is Daily/Misc. Bonus is Included with regular pay:

FIT Withheld on bonus = $375.19

2. Bonus Pay Period is Annual. Bonus is included with regular pay:

FIT Withheld on bonus = $35.76

3. Bonus Pay Period is Daily/Misc. Bonus is a separate check run.

FIT Withheld on bonus = $190.57

4. Bonus Pay Period is Annual. Bonus is a separate check run.

FIT Withheld on bonus = $0

5. Bonus Pay Period is Daily/Misc. Flat Tax Rate is 25%. Bonus is a separate check run.

FIT Withheld on bonus = $219.26

6. Bonus Pay Period is Annual. Flat Tax Rate is 25%. Bonus is a separate check run.

FIT Withheld on bonus = $219.26

As you can see, the amount of tax withheld can vary substantially depending on how you have set up the Pay Code for the Bonus.

How do I get the bonus check to equal a set amount?

Many employers like the bonus check to be devoid of withholding amounts. One approach to this is to take the withholding amount from the regular check. This normally causes the employee be , um, dissatisfied. The answer to this conundrum is the gross-up.

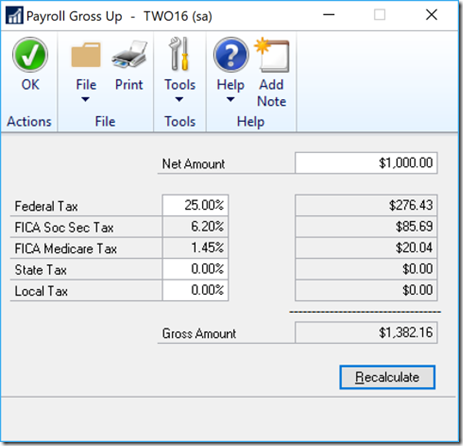

Employers would have to pay a larger gross amount so that after the required withholding is deducted, the desired net amount is achieved. Dynamics GP can perform this calculation for you.

To access the Gross Up utility, navigate to:

HR & Payroll | Utilities | Payroll | Gross Up

Put the net check amount you want, and then adjust the percentages for tax withholding as appropriate. Click on the Calculate button and the system will provide the Gross Amount in order to arrive at the desired check amount. Pretty neat.

I hope this article will give you some food for thought on how to handle the withholding on bonus checks and other supplemental wages.

Live the dream!

Leslie

No comments:

Post a Comment